Money Management

Course: Managing my money

101

Income is a flow of money received over time, e.g. salary, benefits, etc. Wealth is a stock of assets owned and valued at a particular point in time.

Assets can be split into:

Financial → not physical things, held in order to produce a flow of income, e.g. a saving account that pays interest or shares that pay dividends.

Non-financial → tangible items, don't provide income flow, have to be sold to gain money, e.g. property or jewllery.

Assets can be also categorized based on their liquidity, i.e., how easily they can be converted to cash.

"Real" → adjusted for inflation, i.e. a sustained increase over time in the general level of prices for goods and services.

Annual salary increase of 5%, e.g. 20k → 21k

Inflation 5% → Nominal salary value is 21k, but real value is 20k.

Taxations

Income Tax

Income Tax is levied on almost all types of income, including paid employment. When it is collected via an employer it is often referred to as a ‘pay as you earn’ (PAYE) tax. Income Tax is paid on income received within a given tax year, from 6 April of one year to 5 April of the following year.

In the UK Income Tax system most people receive an ‘allowance’ of income that can be earned before Income Tax has to be paid. This ‘personal allowance’ is £11,850 in 2018/19.

£0 - £11,850 (personal allowance)

Personal Allowance

0%

£11,851 - £13,850

Starter Rate

19%

£13,851 - £24,000

Basic Rate

20%

£24,001 - £44,273

Intermediate Rate

21%

£44,274 - £150,000

Higher Rate

41%

£150,001 and above

Additional Rate

46%

UK Income Tax is an example of progressive taxation, meaning that the proportion of a person’s income paid as tax increases as their income increases. This tax structure therefore helps to reduce income inequalities in the UK.

NIN

In 2018/19 there is a primary threshold of £8424 per year and an ‘upper earnings limit’ of £46,384. On income between these limits, employees’ National Insurance is generally levied at 12%. Any portion of income above the upper earnings limit is subject to only a 2% levy.

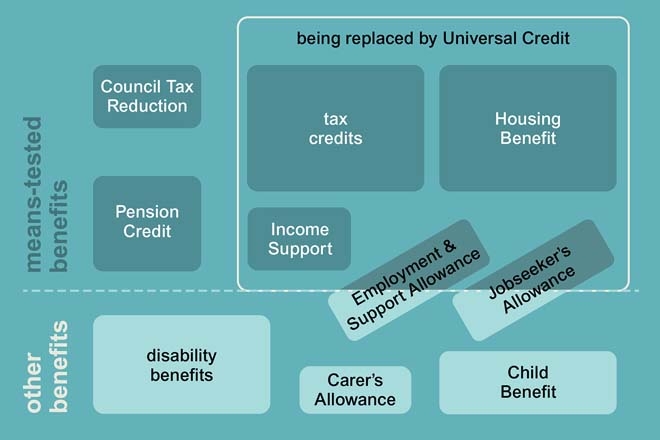

Benefits

One key issue facing governments is a concern that provision of benefits might act as a disincentive for people to seek employment. Related to this is the need to ensure that those on low incomes are not treated unfairly by the tax and benefits system, by making them worse off than those who do not work. One way the UK government has been addressing these issues has been to raise the income threshold at which you start to pay income tax.

Budgeting

A budget identifies and adjusts income and expenditure flows.

Debt

Components

When a person takes on a debt, the total amount to be repaid is made up of three key components:

Principal (or Capital) Sum: The original amount borrowed. For example, if someone borrows £10,000 to purchase a car, that £10,000 is the principal. This sum can be repaid in two main ways:

At the end of the loan term (e.g., after five years), in a single lump sum — this is called an interest-only loan. In this case, the borrower must save separately to pay off the full principal at the end. A historical example of this is the endowment mortgage, where loan repayment is linked to an insurance policy designed to build savings over time.

In regular installments over the life of the loan — this is referred to as a repayment loan.

Interest: The cost of borrowing money. It is usually expressed as a yearly percentage (e.g., 7% per annum or 7% p.a.). Lenders charge interest to:

Compensate for giving up the use of their money.

Cover the risk that the borrower might not repay.

Offset the effects of inflation.

It is worth noting that some religious traditions, such as Islam (under sharia law), prohibit the charging of interest.

Additional Charges: Apart from the principal and interest, there may also be fees involved in arranging, maintaining, or repaying a loan.

Interest

Interest is often calculated based on the average balance of the principal over the year. For example, if £10,000 is borrowed and repaid gradually throughout the year, for example £100 per month, the outstanding balance at the end of year would be £10,000-(£100x12)=£8800. The average balance will be (£10,000+£8800)/2=£9400, reducing the interest owed. At a 7% annual rate, interest would then be £658 instead of £700, reflecting the partial repayments.

If interest is not paid when due, it is usually added to the principal by the lender. This leads to compound interest, where future interest is charged on both the original principal and the unpaid interest. Compounding can cause debts to grow quickly over time.

APR

Last updated